It is often the case that what we see and hear from brands, businesses and people jars with what we might feel, experience and believe. We call this discrepancy between consumer expectations and their experiences the “Authenticity Gap”.

The Authenticity Gap measures the gap between consumer expectations and their actual experience of a company or brand using the Nine Drivers of Authenticity that shape consumer perceptions and beliefs.

Sustainable action becomes a yardstick for reputation

The majority of consumers in Germany (54%) are convinced that companies that not only talk about their own products and services, but also about their commitment to society and the environment, are more credible.

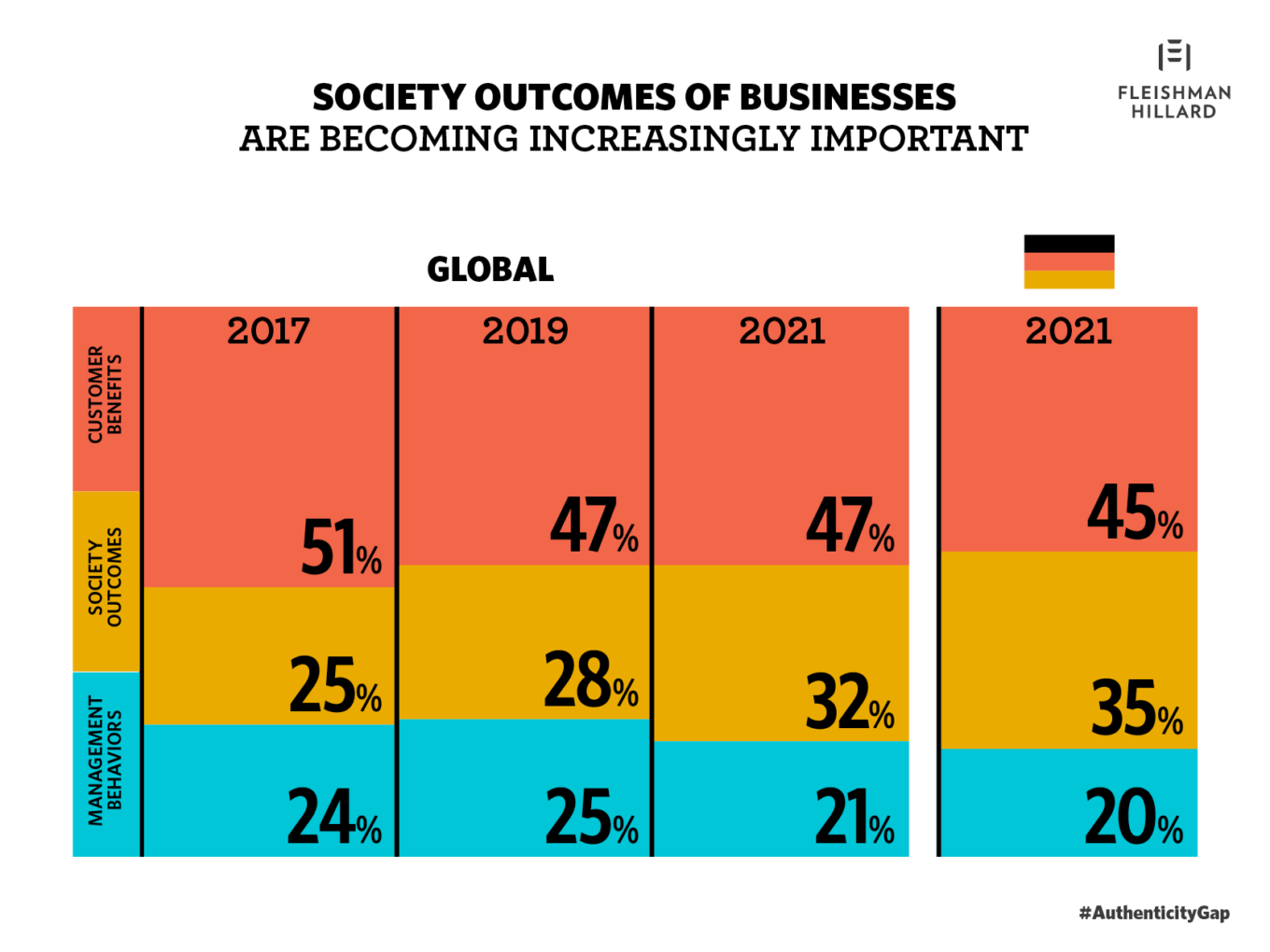

The social contribution of companies becomes more and more important as a reputation driver in the sense of Environmental Social Responsibility (ESG). In the last four years, consumer expectations in Germany have risen by a total of 10 percentage points – three percentage points more than the international average.

Companies should contribute to environmental and climate protection – and fail

German consumers are particularly demanding when it comes to environmental protection. In an international comparison with Brazil, China, the UK and the U.S., consumers in Germany evaluate companies most critical.

Three out of four consumers (74%) demand that companies protect the environment and climate with their working practices. However, 75 percent of the industries surveyed in Germany do not meet customer expectations – especially the energy sector.

Brands are failing to meet expectations on nearly half the nine drivers

In terms of added value for consumers, 80 percent of the industries studied in Germany do not meet expectations. This is particularly true of the banking sector, which has the largest authenticity gap.

In terms of added value for consumers, 80 percent of the industries studied in Germany do not meet expectations. This is particularly true of the banking sector, which has the largest authenticity gap.

Across all industries, consumers expect new, innovative solutions. However, only 40 percent of companies meet this expectation. In the pharmaceutical industry in particular, expectations and reality diverge significantly.

In 45 percent of the sectors, management is unable to convince consumers that it is setting an example and acting ethically (doing the right thing). The gap is largest in the biotechnology sector.

Acting instead of talking

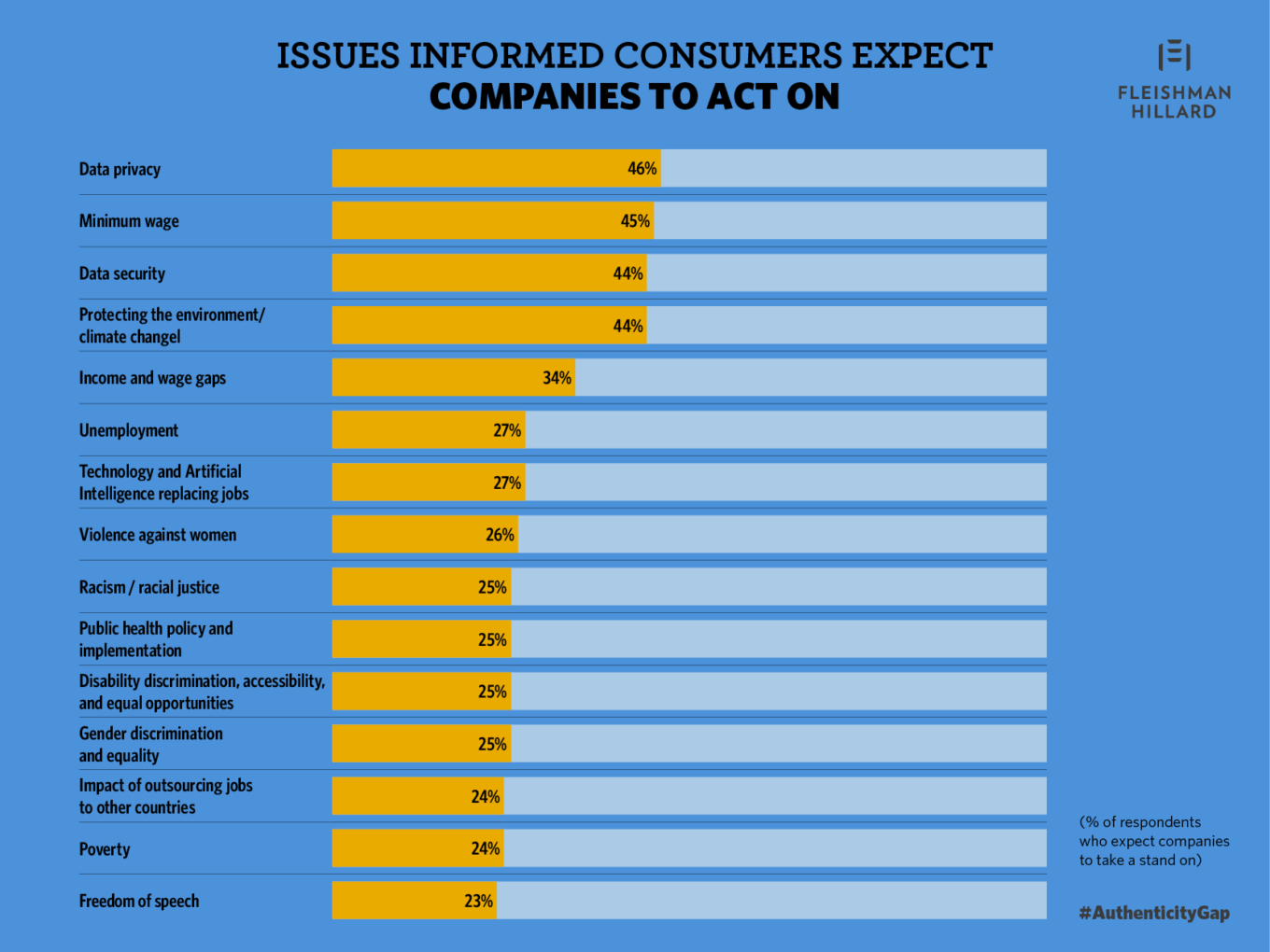

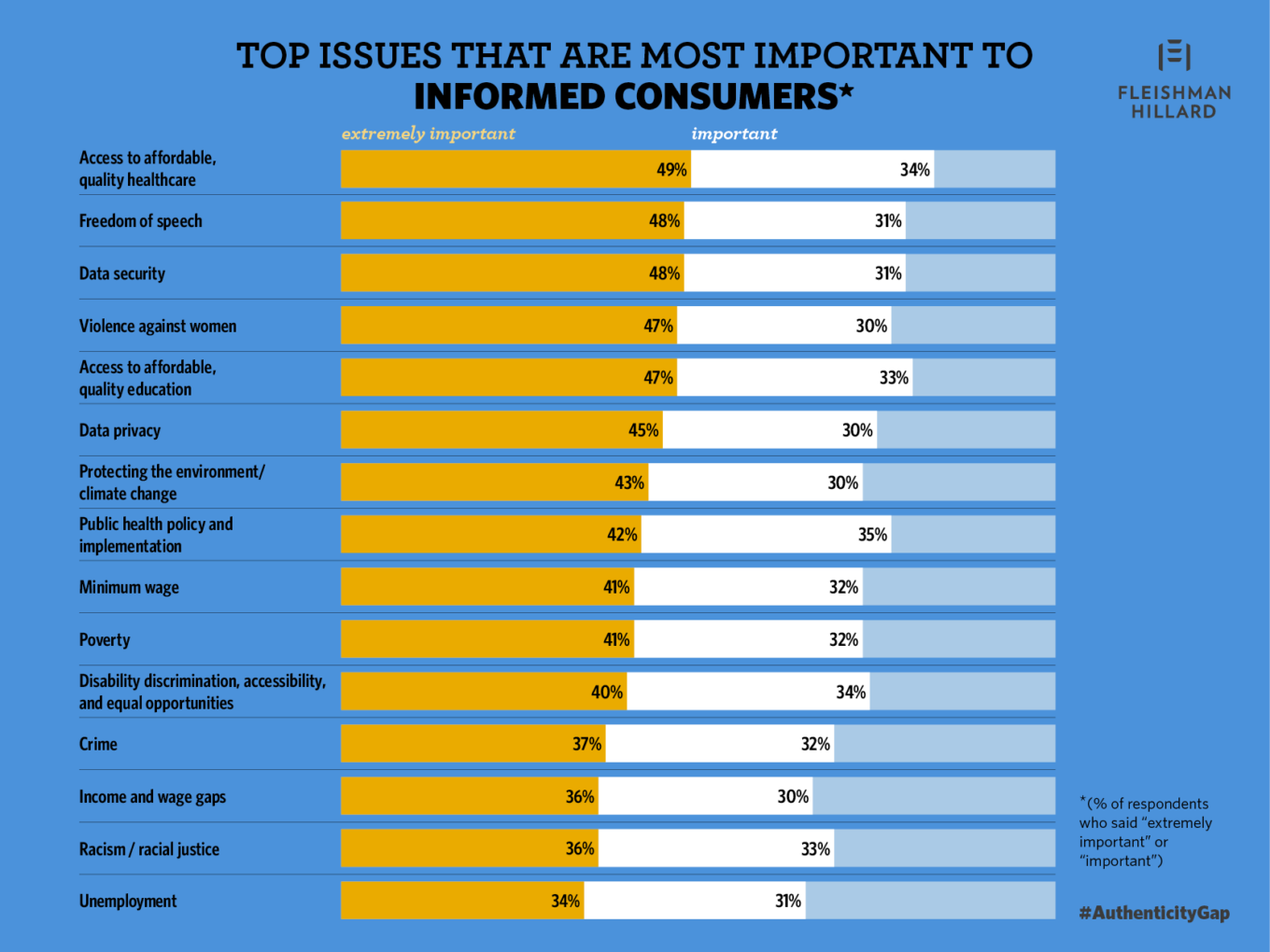

As a social player, businesses are expected not only to be part of the discussion, but also part of the solution. In addition to climate and environmental protection, it is above all social issues that are important to consumers.

However, consumers do not expect brands to take a stand on all the issues that are important to them.

CEOs should take a public stance

However, the expectations of consumers in Germany are not only directed at companies. The majority also want leaders to take an authentic stance on important political and social issues.

However, the expectations of consumers in Germany are not only directed at companies. The majority also want leaders to take an authentic stance on important political and social issues.

Two-thirds (66%) believe CEOs should take an active stance on environmental issues and policy changes. Just under two-thirds (63%) of consumers want CEOs to champion diversity, equality and inclusion – both internally and externally. However, only just under half of consumers in Germany expect CEOs to actively influence government policy (45%). In the U.S. approval is slightly higher (49%). In China (75%) and Brazil (82%), expectations in this regard are at a significantly higher level.

Interactive Authenticity Gap Trend Tool

Using our interactive tool below you can now review this research across industry and market, to give you a clear overview of consumer expectations across customer benefits, society outcomes, and management behaviours. These data points provide insights into what shapes perceptions, and so how industries and companies may be judged from a performance perspective.

Download Global Report

About the 2021 Authenticity Gap study

At FleishmanHillard, we have been studying authenticity since 2012 when we first set out to explore the alignment between consumer expectation and experiences: what we like to call the ‘Authenticity Gap.’ The Authenticity Gap measures the gap between consumer expectations and their actual experience of a company or brand using the Nine Drivers of Authenticity that shape consumer perceptions and beliefs.

The 2021 authenticity research was conducted by FleishmanHillard’s TRUE Global Intelligence, the agency’s in-house research practice. The survey included a total of 10,285 informed consumers in Brazil, China, Germany, UK and the U.S., 18 years of age and older. The ‘informed consumer’ is defined as individuals who are interested or involved with one of the 20 industries that were studied in the 2021 Authenticity Gap research. The survey was fielded online between March 2 and April 16, 2021.

You want to learn more? Contact us.

Hanning Kempe

CEO

Uwe Schubert

Head of Strategy